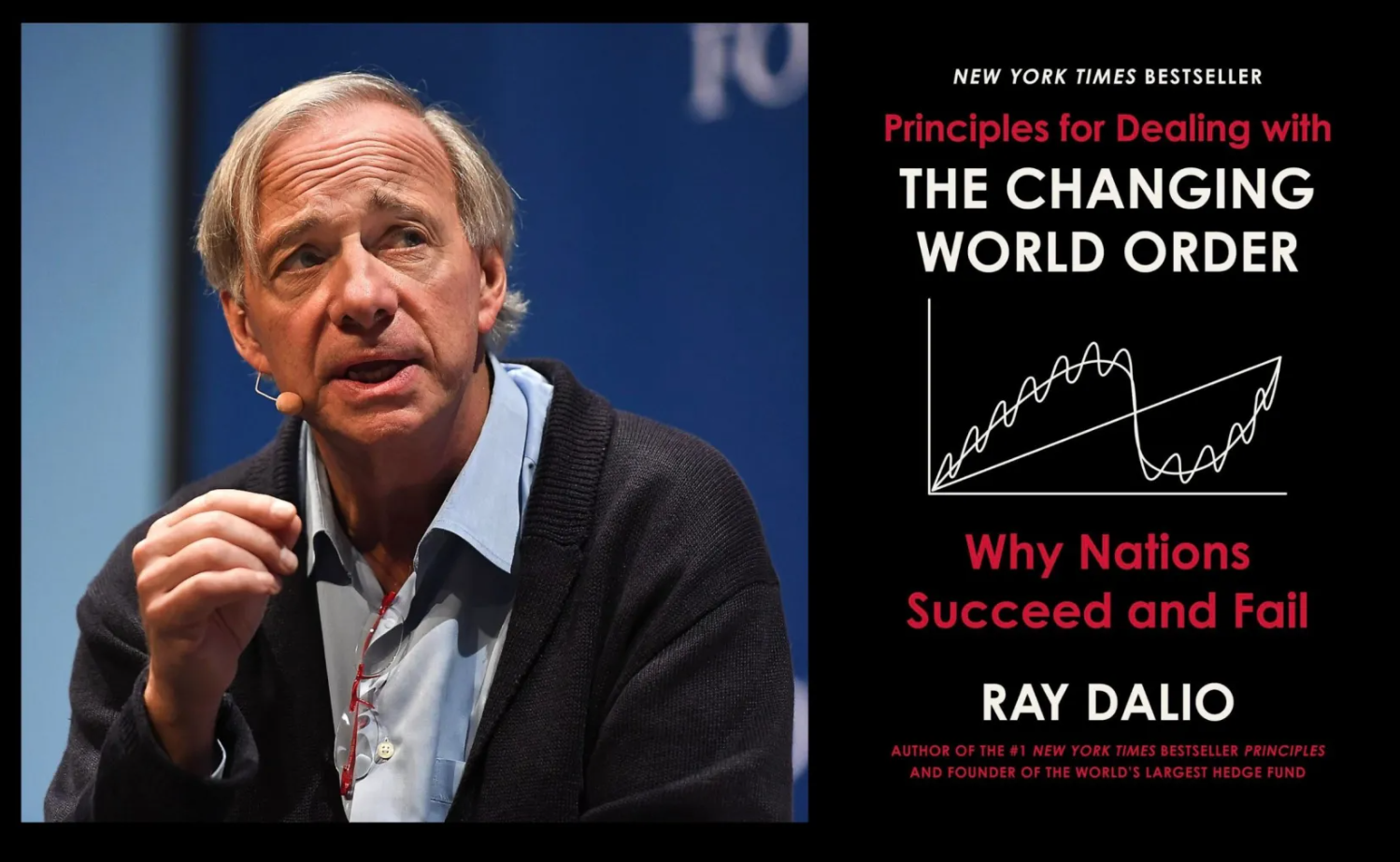

Raymond Dalio is an American investor and hedge fund manager, who has served as co-chief investment officer of the world’s largest hedge fund, Bridgewater Associates, since 1985. He founded Bridgewater in 1975 in New York.

He released a book and Youtube series looking at history and his predictions of the new world order.

Time's up

I studied the 10 most powerful empires over the last 500 years and the last three reserve currencies. It took me through the rise and decline of the Dutch Empire and the Guilder, the British Empire and the Pound, the rise and early decline in the United States Empire and the Dollar, and the decline and rise of the Chinese Empire and its currencies, as well as the rise and decline of the Spanish, German, French, Indian, Japanese, Russian, and Ottoman Empires, along with their significant conflicts as measured in this chart.

To understand China’s patterns better, I also studied the rise and fall of Chinese dynasties and their monies back to the year 600. Because looking at all these measures at once can be confusing, I’ll focus on the four most important ones: the Dutch, British, U.S., and Chinese. You’ll quickly notice the pattern.

Now, let’s simplify the form of it. As you can see, they transpired in overlapping cycles that lasted about 250 years with 10 to 20-year transition periods between them. Typically, these transitions have been periods of great conflict because leading powers don’t decline without a fight. So, how am I measuring an empire’s power?

In this study, I used eight metrics. Each country’s measure of total power is derived by averaging them together. They are education, inventiveness and technology development, competitiveness in global markets, economic output, share of world trade, military strength, the power of their financial center for capital markets, and the strength of their currency as a reserve currency.

Because these powers are measurable, we can see how strong each country is now, was in the past, and whether they’re rising or declining. By examining the sequences from many countries, we can see how a typical cycle transpires. And because the wiggles can be confusing, we can simplify it a bit to focus on the pattern of cause-effect relationships that drive the rise and decline of a typical empire.

As you can see, better education typically leads to increased innovation and technology development, and with a lag, the establishment of the currency as a reserve currency. You can also see that these forces then decline in a similar order, reinforcing each other’s decline.

Let’s now look at the typical sequence of events going on inside a country that produces these rises and declines. In a nutshell, the big cycle typically begins after a major conflict, often a war, establishes the new leading power and the new world order. Because no one wants to challenge this power, a period of peace and prosperity typically follows. As people get used to this peace and prosperity, they increasingly bet on it continuing. They borrow money to do that, which eventually leads to a financial bubble. The empire’s share of trade grows, and when most transactions are conducted in its currency, it becomes a reserve currency, which leads to even more.

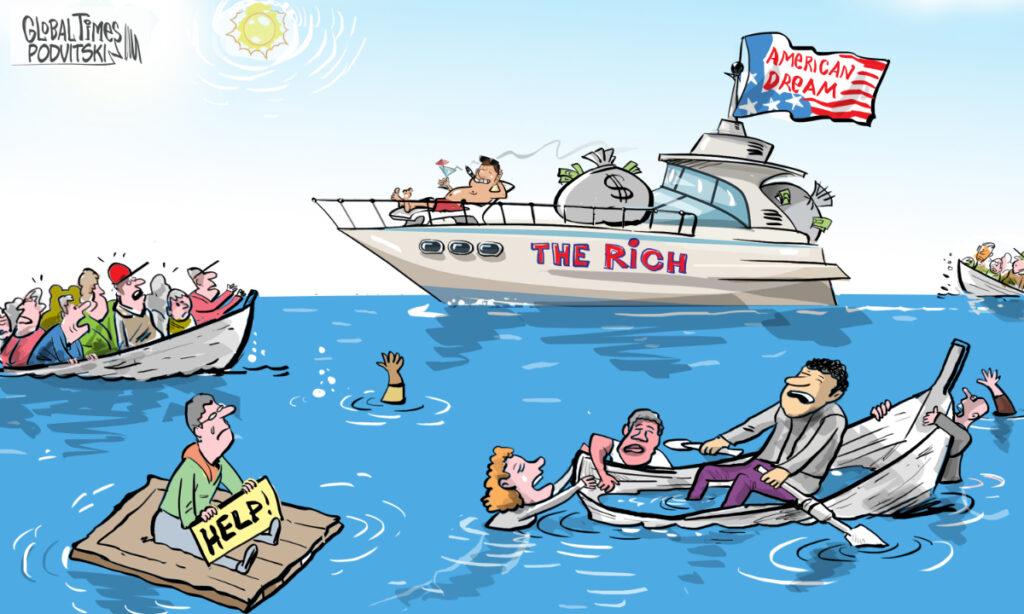

At the same time, this increased prosperity distributes wealth unevenly, so the wealth gap typically grows between the rich “haves” and the poor “have-nots.” Eventually, the financial bubble bursts, which leads to the printing of money and increased internal conflict between the rich and the poor, which leads to some form of revolution to redistribute wealth. This can happen peacefully or as a civil war. While the empire struggles with this internal conflict, its power diminishes relative to external rival powers on the rise. When a new rising power gets strong enough to compete with the dominant power that is having domestic breakdowns, external conflicts, most typically wars, take place.

Out of these internal and external wars come new winners and losers. Then, the winners get together to create the new world order, and the cycle begins again.

- Reserve Currency

- Explanation: A currency held in significant quantities by governments and institutions as part of their foreign exchange reserves. Commonly used in international trade and finance.

- Example: The U.S. dollar is the most widely held reserve currency in the world.

2. Financial Bubble

- Explanation: A situation where the price of an asset far exceeds its intrinsic value due to excessive demand, leading to a sharp rise followed by a sudden collapse.

- Example: The housing market experienced a financial bubble in the early 2000s, leading to the 2008 financial crisis.

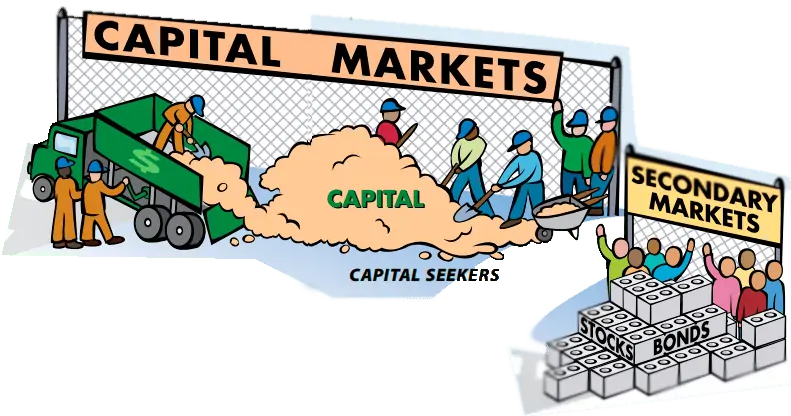

3. Capital Markets

- Explanation: Markets where buyers and sellers trade financial securities like stocks and bonds, typically for long-term investments.

- Example: Companies raise funds for expansion by issuing shares in capital markets.

4. Economic Output

- Explanation: The total value of all goods and services produced in an economy, often measured by Gross Domestic Product (GDP).

- Example: The economic output of the country increased by 3% last year, indicating growth.

5. Share of World Trade

- Explanation: The proportion of a country’s exports and imports relative to total global trade.

- Example: China’s share of world trade has been steadily increasing, making it one of the leading exporters globally.

6. Wealth Gap

- Explanation: The disparity in the distribution of wealth between the rich and the poor within a society.

- Example: The wealth gap has widened in many countries, with the top 1% owning a large proportion of the total wealth.

7. Printing of Money

- Explanation: The process by which a central bank increases the money supply by producing more currency, often leading to inflation if not managed properly.

- Example: During the crisis, the central bank resorted to the printing of money to stimulate the economy.

8. Military Strength

- Explanation: The capability of a nation’s military forces, often measured in terms of size, technology, and power projection.

- Example: The military strength of a country is a critical factor in its ability to defend itself and exert influence globally.

9. Internal Conflict

- Explanation: Disputes and unrest within a country, often between different groups or social classes, that can lead to instability.

- Example: The internal conflict between the government and rebel forces has destabilised the region.

10. External Rival Powers

- Explanation: Other countries or entities that pose a competitive or threatening force to a nation’s dominance or interests.

- Example: The rise of external rival powers can challenge the existing world order.

11. Rise and Decline

- Explanation: Refers to the process of growth followed by a decrease in power, influence, or economic performance.

- Example: The rise and decline of the Roman Empire is a well-documented historical phenomenon.

12. New World Order

- Explanation: A significant shift in political, economic, or social structures on a global scale, often after a major conflict.

- Example: After World War II, the new world order was characterised by the rise of the United States and the Soviet Union as superpowers.

13. Power Diminishes

- Explanation: The gradual reduction in a country’s or organization’s influence, control, or authority.

- Example: As the empire’s power diminishes, rival nations start to challenge its dominance.

14. Increased Prosperity

- Explanation: A situation where the economic well-being of individuals or a nation improves, leading to higher wealth and better living standards.

- Example: The country’s increased prosperity has led to a higher standard of living for its citizens.

15. Leading Power

- Explanation: The most dominant country or entity in terms of political, economic, or military influence.

- Example: The United States emerged as the leading power after World War II.

- What do you think of Dalio’s thoughts?

- Do you know much about Economics?

- How important is Economics? Do you think people are taught enough about Economics?

- How do you see the world economies changing over the next century?

- Do you trade stocks? Which stocks do you think will do well and which not so well in the coming years?